Cash Flow Statement

Cash Flow Statement

For those who may prefer, this presentation covers the same principles explained in the text below:

Contents:

Fundamental Definitions

Differences in Categorisation

Differences in Reporting

Basic Cash Flow Statement

Goals of the Analysis

Ratios

Important Analysis Questions

Thank you

“What Should I Do Next?”

Contact Information

Introduction

Fundamental Definitions:

Cash Flow Statement (Statement of Cash Flows)

A financial statement that summarises the amounts of cash and cash equivalents that entered and left a company over a specific period.

It helps analysts and investors understand how well a company manages its cash flow, meaning how well the company generates cash to pay its debt obligations and meet its operating expenses.

Cash Equivalents: Short-term (three months or less) investments that are easily sold, have high credit quality, and are readily convertible to known amounts of cash. Examples include U.S. Treasury Bills (T-Bills).

The cash flow statement is divided into three sections:

Cash Flow from Operating Activities

Cash Flow from Investing Activities

Cash Flow from Financing Activities

Cash Flow from Operating Activities

Cash flow resulting from the regular business operations of the company. This generally involves cash generated from the company’s products and services.

When this cash flow is positive, it means the company is achieving a positive net cash flow from its normal business operations.

When this cash flow is negative, it means the company is failing to earn a positive net cash flow from its normal business operations.

Cash Flow from Investing Activities

Cash flow associated with investment activities conducted by the company. This may involve the purchase or sale of property, plant and equipment; intangible assets; other non-current assets; and long-term and short-term investments in equity and debt.

When this cash flow is positive, it indicates that the company is selling investments.

When this cash flow is negative, it indicates that the company is increasing investment.

Cash Flow from Financing Activities

Cash flow resulting from the company obtaining or repaying capital for business operations.

When this cash flow is positive, it indicates that the company has raised capital through activities such as selling bonds, taking on loans, and issuing stock.

When this cash flow is negative, it indicates that the company has paid out capital for activities such as paying off debt, making dividend payments, and stock repurchases.

IFRS versus GAAP

Differences in Categorisation:

IFRS

International Financial Reporting Standards (IFRS)

Followed by companies in about 150 countries, including those in the European Union (EU).

GAAP

Generally Accepted Accounting Principles (GAAP)

Predominant accounting principles, standards and procedures followed by companies in the United States.

Interest Paid

IFRS: Operating or Financing Activity

GAAP: Operating Activity

Dividends Paid

IFRS: Operating or Financing Activity

GAAP: Financing Activity

Interest Received

IFRS: Operating or Investing Activity

GAAP: Operating Activity

Dividends Received

IFRS: Operating or Investing Activity

GAAP: Operating Activity

Direct and Indirect Methods

Differences in Reporting:

Cash flow from operating activities may be presented in one of two different formats:

Direct Method

Indirect Method

IFRS and GAAP accept both methods, but encourage the direct method.

Direct Method

Cash receipts from operating activities less cash payments from operating activities.

Indirect Method

Begins with net income from the income statement. Additions and subtractions are then applied to arrive at operating cash flow.

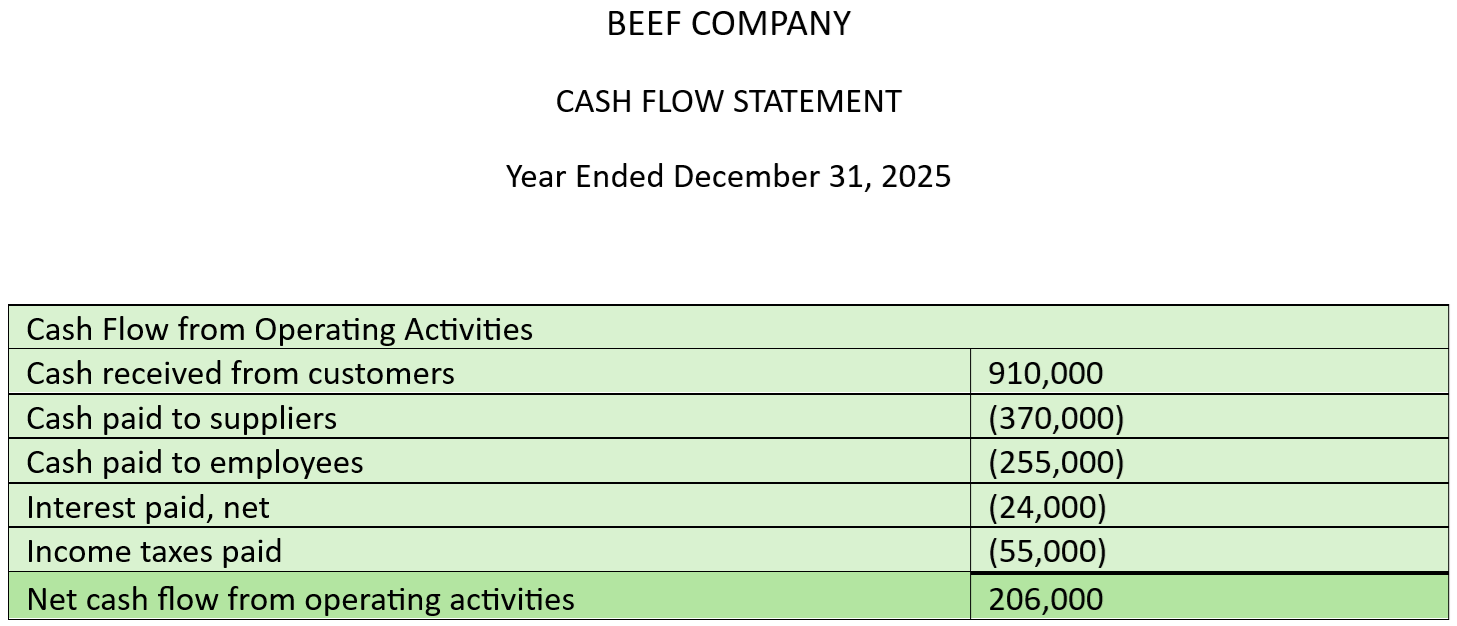

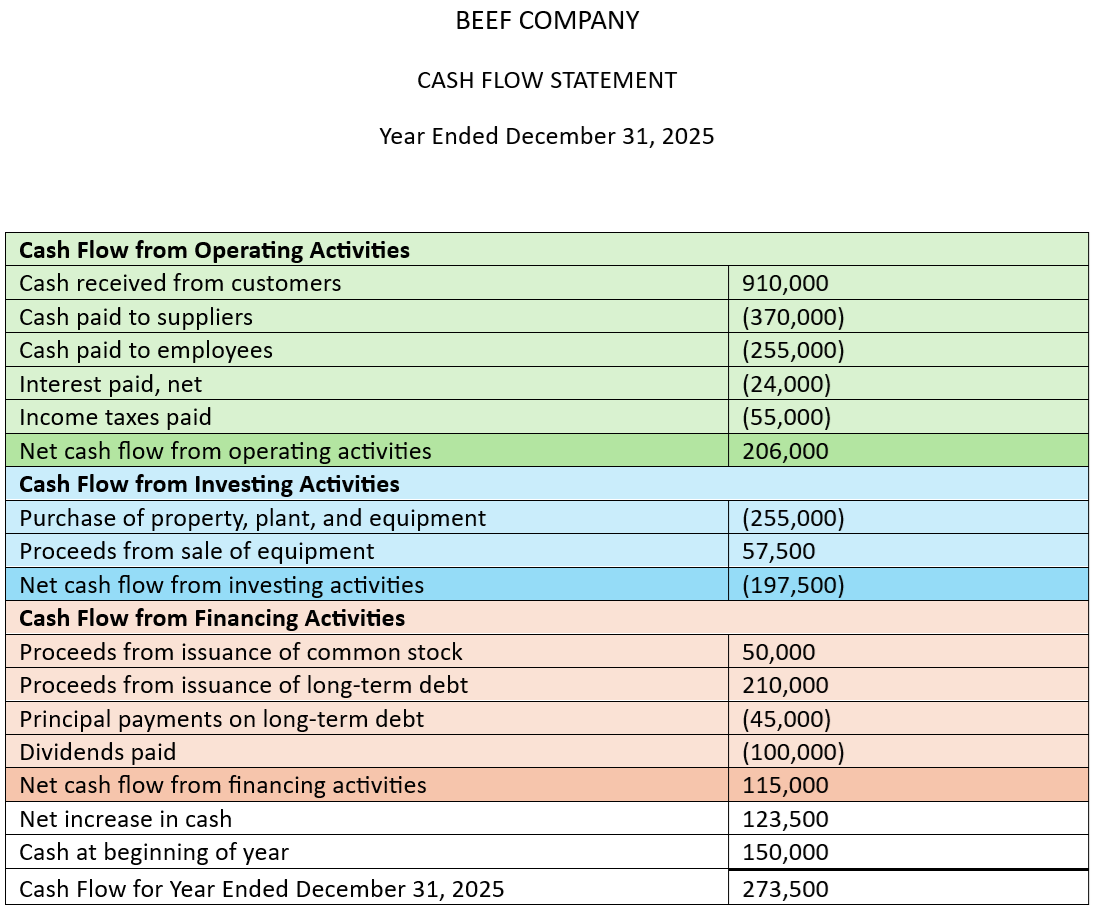

Basic Cash Flow Statement:

Using the Direct Method:

Cash Flow Statement Analysis

Goals of the Analysis:

Overall Goals of the Analysis

Understand and evaluate the sources and uses of the company’s cash flow in each of the three main categories (operating, investing and financing).

Ratios:

Performance Ratios:

Cash Flow to Revenue

CFO / Revenue

Cash Return on Assets

CFO / Average total assets

Cash Return on Equity

CFO / Average shareholders’ equity

Cash to Income

CFO / Operating income

Cash Flow per Share *

(CFO – Preferred dividends) / Number of common shares outstanding

* If the company reports under IFRS and includes total dividends paid as a use of cash under operating activities, total dividends should be added back to CFO before preferred dividends is subtracted.

Coverage Ratios:

Debt Coverage

CFO / Total debt

Interest Coverage *

(CFO + Interest paid + Taxes paid) / Interest paid

Reinvestment

CFO / Cash paid for long term assets

Debt Payment

CFO / Cash paid for long term debt repayment

Dividend Payment

CFO / Dividends paid

Investing and Financing

CFO / Cash outflows for investing and financing activities

* If the company reports under IFRS and includes interest paid as a use of cash under financing activities, then interest paid should not be added back to the numerator.

Important Analysis Questions:

Does the company source most of its cash flow from operating, investing or financing activities?

What are the major determinants of operating cash flow?

How relevant are the company's main sources of cash flow to its core products and/or services?

Have the levels of operating cash flows been consistent over time?

Is operating cash flow positive and sufficient to cover capital expenditures?

How sustainable are the company's sources of cash flow?

What are the major uses of the cash flow?

What are the primary determinants of investing cash flow?

What are the primary determinants of financing cash flow?

Capital Expenditure (Capex)

Capital expenditure involves what a company spends to maintain existing property and equipment, and invest in new technologies and other assets important for future growth.

Conclusion

Thank you for visiting School of Value Investing.

“What should I do next?”

Learn to speak the language of business and investment like the legends:

Check out Warren Buffett Investing Series II.

Become a more intelligent investor by understanding the Commodities Investment Industry.