Balance Sheet

Balance Sheet

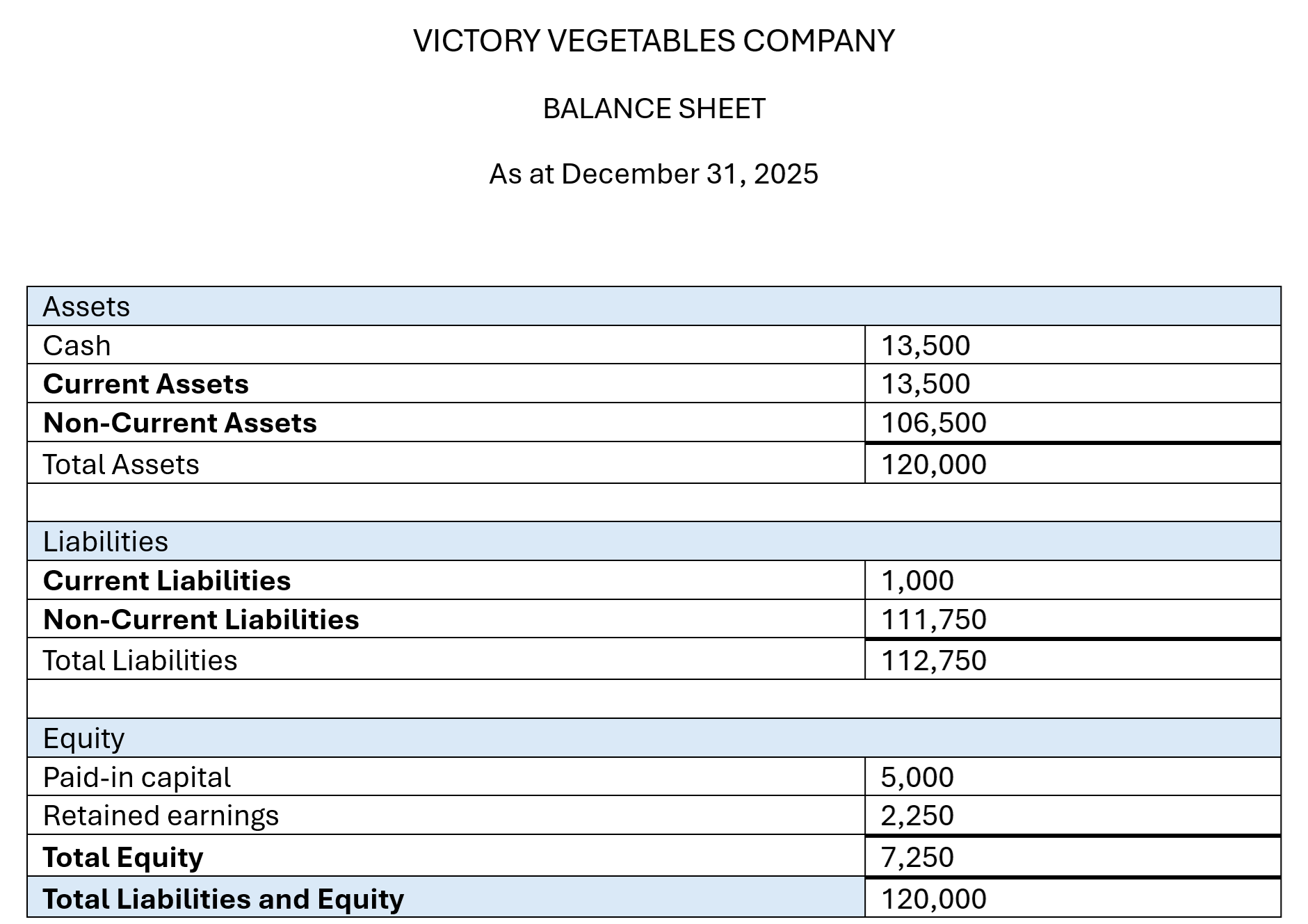

For those who may prefer, this presentation covers the same principles explained in the text below:

Contents:

Fundamental Definitions

Basic Balance Sheet

Current Assets

Non-Current Assets

Financial Assets

Current Liabilities

Non-Current Liabilities

Five Components of Owners’ Equity

Essential Definitions

Ratios

Important Analysis Questions

Thank you

“What Should I Do Next?”

Introduction

Fundamental Definitions:

Balance Sheet (Statement of Financial Position/Condition)

A balance sheet presents an entity’s current financial position by disclosing its assets, liabilities and equity as of a particular point in time.

It is one of three very important financial statements which investors analyse to better understand a company. The other two being the income statement and the cash flow statement.

Assets

Resources controlled by a company from which future economic benefits to the company are expected to flow.

Liabilities

Obligations of a company, the settlement of which is expected to result in outflows of resources embodying economic benefits.

Equity

Assets less liabilities; the residual interest in the assets after subtracting the liabilities.

Current Assets

Assets that are cash or cash equivalents; or are expected to be converted into cash, sold, or consumed within 12 months. All other assets are classified as Non-Current Assets.

Current Liabilities

Liabilities that are expected to be settled within 12 months. All other liabilities are classified as Non-Current Liabilities.

Working Capital (Net Working Capital)

The difference between current assets and current liabilities.

Basic Balance Sheet:

Accounting Equation

Assets = Liabilities + Equity

Paid-In Capital

The amount of money or other assets that shareholders contribute to a company in exchange for its (common or preferred) stock. It represents the owners’ investment in the business.

Retained Earnings

The accumulated profits of a company that have not been distributed to shareholders as dividends. These earnings are kept in the business to support growth, operations, or other needs.

Components of Assets

Current Assets:

Cash and Cash Equivalents

Highly liquid, short-term investments (within three months of maturity).

Marketable Securities

Investments in debt or equity securities that are traded in a public market. The trading of these financial instruments in the public market allows the market price to be determined. Examples include treasury bills, bonds, and common stock.

Trade Receivables (Accounts Receivable)

Amounts owed to a company by its customers for products or services already delivered or rendered.

Inventories

Physical products ultimately to be sold to the company’s customers, either in their current form (finished goods) or as inputs into a process to manufacture a final product (raw materials or work-in-process).

Prepaid Expenses

A normal operating expense which has been paid in advance of when it is due.

Deferred Tax Assets

An asset which can be used to reduce future income tax expenses. This asset usually arises when a company pays an excess in taxes relative to the actual income taxes due on net profit or when a company pays taxes in advance.

Non-Current Assets:

Property, Plant and Equipment (PPE) (Fixed Assets)

Tangible, long-term assets that are vital to the company’s operations and are not very liquid. They are expected to be used in the production or supply of goods and services or for administrative purposes.

Investment Property

Property bought for the purpose of generating rental income or capital appreciation or both.

Intangible Assets

Assets that lack physical substance. Examples include trademarks and patents.

Goodwill

Accounting Goodwill: An intangible asset which is the positive difference between the purchase price of an acquired company over the value of net assets acquired.

Economic Goodwill: The subjective value of the intangible advantages a company has in comparison to its industry competitors. These advantages may include a reputation for excellence, loyal customers, and key business connections.

Financial Assets:

IFRS defines a financial instrument as “a contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.”

Financial assets do not automatically fall into one category. Their classification as Current or Non-Current depends on the owner’s intention, the nature of the asset, and its maturity.

Derivatives

A financial instrument whose value is reliant upon or derived from an underlying asset or factor, such as a stock price or interest rate.

Held-to-Maturity

Debt (fixed-income) securities that a company purchases and intends to hold until maturity.

Held-for-Trading (Trading Securities)

Debt or equity financial assets bought with the intention to sell in the near term, usually within three months to a year.

Available-for-Sale

Debt and equity securities not classified as either “held-to-maturity” or “held-for-trading”. The investor is willing to sell, but not actively planning on doing so.

Components of Liabilities

Current Liabilities:

Trade Payables (Accounts Payable)

Amounts that a company owes to its suppliers for goods or services purchased.

Notes Payable

Amounts owed by a company to creditors as a result of short-term borrowing through loan agreements.

Accrued Expenses (Accrued Liabilities)

Expenses that have been incurred but not yet paid as of the end of an accounting period. An example is rent payable.

Deferred Income (Deferred/Unearned Revenue)

Money that has been collected for goods or services that have not yet been delivered. (Payment received in advance.)

Non-Current Liabilities:

Long-Term Financial Liabilities

Typically, these include fixed-income securities issued to investors. Examples include loans, notes and bonds payable.

Deferred Tax Liabilities

A liability which arises when an insufficient amount is paid for income taxes in a specific period. This typically occurs because of a difference in timing between when the tax is accrued and when it is paid. The deferred tax liability records the fact that the company expects to eliminate this liability over the course of future business operations.

Components of Equity

Five Components of Owners’ Equity:

Equity attributable to the owners of the parent company:

1) Contributed Capital (Paid-In Capital)

2) Treasury Shares (Treasury Stock / Own Shares Repurchased)

3) Retained Earnings

4) Accumulated Other Comprehensive Income (Other Reserves/Components)

Equity attributable to non-controlling interests:

5) Non-Controlling Interest (Minority Interest)

1. Contributed Capital (Paid-In Capital):

Cash and other assets that owners have given a company in exchange for common and preferred stock.

It is often split into two sections:

Common Stock: Par value of the stock owned by shareholders.

Additional Paid-In Capital: The value paid by investors above and beyond the par value of the stock when buying shares directly from the issuing company.

Par Value: Companies are sometimes legally required to set a par value below which shares cannot be sold. Usually, companies set this par value very low; for instance, at one cent per share.

Contributed Capital = Common Stock + Additional Paid-In Capital

2. Treasury Shares (Treasury Stock / Own Shares Repurchased):

Shares in the company that the company has repurchased from investors or outstanding shares that the company did not sell. The company may sell treasury shares at a later date.

A purchase of treasury shares decreases owners’ equity by the amount paid for the stock and reduces the number of total shares outstanding.

Treasury shares do not have any company voting rights and do not receive any dividends declared by the company.

3. Retained Earnings:

The cumulative amount of earnings recognised in the company’s income statements which have not been paid to the owners of the company as dividends.

Retained Earnings =

Beginning of Period Retained Earnings

+ Net Profit (or Loss)

- Cash Dividends

- Stock Dividends

Stock Dividend: A dividend paid to shareholders in the form of shares rather than cash.

4. Accumulated Other Comprehensive Income (Other Reserves/Components):

The cumulative amount of other comprehensive income or loss.

Comprehensive income includes:

Net Profit: Listed on the income statement and accounted for in retained earnings.

Other Comprehensive Income: Not included in the net profit calculation and is accounted for in accumulated other comprehensive income.

Other Comprehensive Income: Items that cannot be captured on the income statement because they do not result from the company’s regular business activities and operations.

5. Non-Controlling Interest (Minority Interest):

A non-controlling interest refers to an ownership position wherein the shareholder owns less than 50% of the outstanding stock.

On the balance sheet, the non-controlling interest listed represents the equity interests of minority shareholders in subsidiary companies that have been consolidated by the parent company but that are not wholly owned by the parent company.

Balance Sheet Analysis

Essential Definitions:

Liquidity

Liquidity refers to the ease with which an asset or security can be bought or sold without affecting the market price.

With regard to financial statement analysis, it refers to a company’s ability to meet its short-term obligations using its liquid assets.

Solvency

With regard to financial statement analysis, solvency refers to a company’s ability to meet its long-term debts and obligations.

Capital Structure

The mix of debt and equity used by a company to finance its overall operations and growth.

Examples of debt include bond issues and loans.

Examples of equity include common stock, preferred stock, and retained earnings.

Ratios:

Liquidity Ratios:

Financial ratios measuring the company’s ability to meet its short-term obligations.

Current Ratio

(Current Assets) / (Current Liabilities)

Quick (Acid Test) Ratio

( (Cash + Marketable Securities + Receivables) ) / (Current Liabilities)

Cash Ratio

( (Cash + Marketable Securities) ) / (Current Liabilities)

Marketable Security

A financial asset which can be converted into cash at a reasonable price within one year.

Solvency Ratios:

Financial ratios measuring the company’s ability to meet its long-term obligations.

Long-Term Debt-to-Equity

(Long Term Debt) / (Total Equity)

Debt-to-Equity

(Total Debt) / (Total Equity)

Total Debt

(Total Debt) / (Total Assets)

Financial Leverage

(Total Assets) / (Total Equity)

Important Analysis Questions:

What are the company's levels of debt, both present and over the past 5-10 years?

How do the company’s debt levels compare to those of its competitors?

How strong is the company’s liquidity?

Is the company solvent?

What are the trends of the company’s liquidity and solvency?

In terms of financial position, how does the company compare to its industry competitors?

Conclusion

Thank you for visiting School of Value Investing.

“What should I do next?”

Learn to speak the language of business and investment like the legends:

Understand how to read and analyse the Cash Flow Statement.