Income Statement

Income Statement

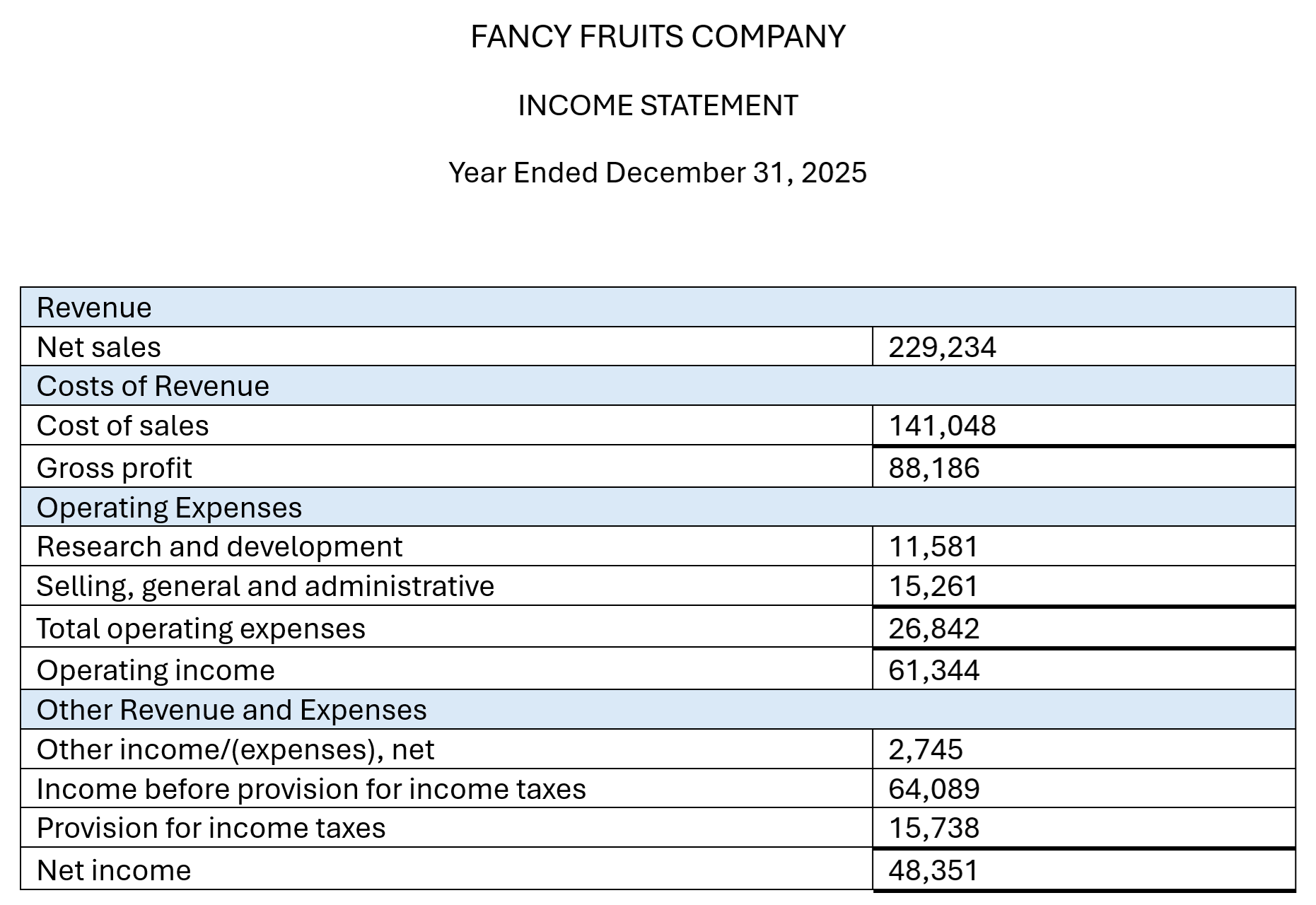

For those who may prefer, this presentation covers the same principles explained in the text below:

Contents:

Fundamental Definitions

Basic Income Statement

Components of the Income Statement

Essential Definitions

IFRS and GAAP

Comprehensive Income

Earnings per Share (EPS)

Ratios

Important Analysis Questions

Thank you

“What Should I Do Next?”

Introduction

Fundamental Definitions:

What is an income statement?

An income statement details a company’s financial performance over a specified accounting period.

It is one of three very important financial statements which investors analyse to better understand a company. The other two being the balance sheet and the cash flow statement.

Revenue (Total Sales)

The amount charged for the delivery of goods or services in the ordinary activities of a business.

Cost of Goods Sold (COGS)

The direct costs of producing the goods or services sold by a business. Examples include raw materials and labour.

Gross Profit (Gross Margin)

Revenue minus cost of goods sold.

Operating Expenses

The costs incurred by a company through its normal business operations. Examples include wages, research & development and rent.

Operating Profit (Operating Income)

Gross profit minus operating expenses. A company’s profit on its usual business activities before accounting for interest and taxes.

Net Profit (Net Income)

Operating profit minus interest expenses and taxes.

Net profit can be put back into the business or paid out to the owners or some combination of the two.

Basic Income Statement:

Other income/(expense), net

Involves items that do not occur during the company’s normal course of business. An example here would be income from rental property.

Components of the Income Statement

Essential Definitions:

Long-Lived (Non-Current) Assets

Assets that are expected to provide economic benefits over a future period of time, typically greater than one year.

Intangible Assets

Assets lacking physical substance, such as patents and trademarks.

Depreciation

The process of systematically allocating the cost of tangible long-lived assets to the periods during which the assets are expected to provide economic benefits.

Straight-Line Method: A depreciation method that allocates evenly the cost of a long-lived asset less its estimated residual value over the estimated useful life of the asset.

Accelerated Method: Depreciation methods that allocate a relatively large portion of the cost of an asset to the early years of the asset’s useful life.

Amortisation

The process of allocating the cost of intangible long-life assets having a finite useful life to accounting periods.

Intangible assets with indefinite life are not amortised. Instead, they are periodically reviewed as to the reasonableness of continuing to assume an indefinite useful life and are tested at least annually for impairment.

What is a Share?

A share of a company represents an equity ownership interest in that company. Equity can be represented by common shares or preferred shares.

Ordinary Shares (Common Shares)

Equity shares that are subordinate to all other types of equity, such as preferred shares.

Preferred Shares

Preferred shareholders have a superior claim to distributions, such as dividends, than do common shareholders.

Diluted Shares

The number of shares that would be outstanding if all potentially dilutive claims on common shares (e.g. convertible preferred shares, employee stock options) were exercised.

“Shares” vs. “Stocks”

In today’s markets, for all intents and purposes, these words refer to the same thing. That is, a stake of ownership in a company.

EBT, EBIT, EBITA, EBITDA, EBITDAR

Earnings before:

Interest

Taxes

Depreciation

Amortisation

Restructuring or Rental Costs

Footnotes

Footnotes to the financial statements provide additional information about how a company arrived at certain financial figures.

They are very important to understand when analysing a company’s income statement, balance sheet and cash flow statement.

Comprehensive Income

IFRS and GAAP:

IFRS

International Financial Reporting Standards (IFRS)

IFRS set common rules so that financial statements can be consistent, transparent, and comparable around the world.

IFRS are issued by the International Accounting Standards Board (IASB).

IFRS is followed in about 150 countries, including those in the European Union (EU).

GAAP

Generally Accepted Accounting Principles (GAAP)

GAAP refer to a common set of accounting principles, standards, and procedures.

GAAP are issued by the Financial Accounting Standards Board (FASB).

Public companies in the United States must follow GAAP when their accountants compile their financial statements.

Comprehensive Income:

Comprehensive Income

Net income from the Income Statement + Total other comprehensive income from the Statement of Other Comprehensive Income

Other Comprehensive Income

Includes items that cannot be captured on the income statement because they do not result from the company’s regular business activities and operations.

Accumulated other comprehensive income is reported under the equity section of the balance sheet.

Other comprehensive income includes four items:

Certain adjustments to defined-benefit post-retirement plans

Foreign currency transactions

Value changes in derivatives contracts accounted for as hedges

Value changes in securities which the company holds to sell

Reporting Options:

One complete comprehensive statement (IFRS and GAAP)

Two statements: income statement plus other comprehensive income statement (IFRS and GAAP)

Income Statement Analysis

Earnings per Share (EPS):

Basic EPS

Net profit available to common shareholders divided by the weighted average number of common shares outstanding.

Basic EPS = (Net Income - Preferred Dividends) / Weighted average number of shares outstanding

Diluted EPS

The EPS that would result if all dilutive securities, such as convertible preferred shares and employee stock options, were converted into common shares.

Weighted Average Number of Shares Outstanding

A time weighting of common shares outstanding. For example…

Assume a company began the year with 1,000,000 common shares outstanding and repurchased 100,000 common shares on 1 July.

The weighted average number of common shares outstanding at the end of the year would be (1,000,000 shares * 0.5 years) + (900,000 shares * 0.5 years) = 950,000 shares.

Ratios:

Net Profit Margin (Profit Margin or Return on Sales)

Indicates how much of each dollar of revenue is left after all costs and expenses.

Net Profit Margin = (Net Profit) / Revenue

Gross Profit Margin

Measures the amount of gross profit generated for each dollar of revenue.

Gross Profit Margin = (Gross Profit) / Revenue

Operating Profit Margin (Operating Margin)

Operating Profit Margin = (Operating Profit) / Revenue

Pre-Tax Margin

Pre-tax Margin = (Net Profit before Taxes) / Revenue

Important Analysis Questions:

Has the business demonstrated consistent earning power?

Are the sources of income sustainable?

Do the expenses make sense?

Is an increase/decrease in revenue because of a change in units sold, a change in price, or both?

If the company has multiple business segments, how is each individual segment performing?

Are gross, operating and net margins steady or increasing? What are the relevant trends involved?

How does the company compare with industry competitors?

Conclusion

Thank you for visiting School of Value Investing.

“What should I do next?”

Learn to speak the language of business and investment like the legends:

Understand how to read and analyse the Balance Sheet.